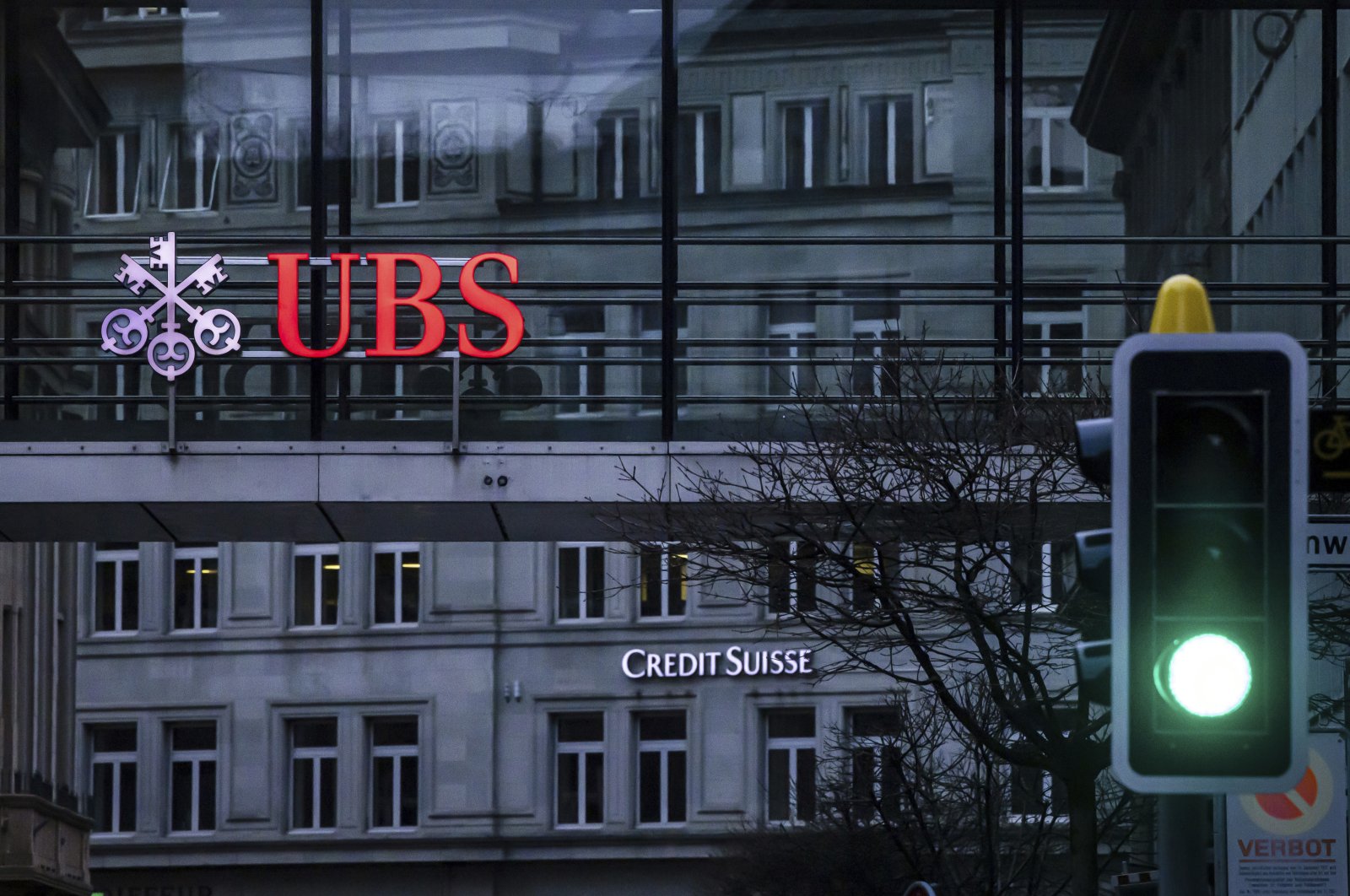

UBS mentioned Monday it had efficiently concluded its acquisition of troubled rival Credit Suisse, forming a large banking establishment with a steadiness sheet totaling $1.6 trillion and extra vital muscle in wealth administration.

The announcement comes almost three months after the Swiss authorities swiftly organized a rescue deal to mix the nation’s two largest banks to safeguard Switzerland’s repute as a worldwide monetary middle and choke off market turmoil.

An announcement from the financial institution mentioned that “UBS has completed the acquisition of Credit Suisse today, crossing an important milestone.”

Announcing the most important banking deal because the 2008 world monetary disaster, UBS Chief Executive Sergio Ermotti and Chairperson Colm Kelleher mentioned it could create challenges but in addition “many opportunities” for shoppers, staff, shareholders, and Switzerland.

“This is the start of a new chapter – for UBS, which calls itself the world’s largest wealth managers, Switzerland as a financial center and the global financial industry,” they mentioned in an open letter printed in Swiss newspapers.

They haven’t any doubts that they may efficiently deal with the takeover, the letter added.

The group will oversee $5 trillion of property giving UBS a number one place in key markets it could in any other case have wanted years to develop in dimension and attain. The merger additionally brings to an finish Credit Suisse’s 167-year historical past, marred in recent times by scandals and losses.

Credit Suisse shares had been up 0.9% on their final day of buying and selling, whereas UBS had been up round 0.8% in early commerce.

The two banks collectively make use of 120,000 worldwide, though UBS has already mentioned it is going to be slicing jobs to scale back prices and make the most of synergies.

UBS agreed on March 19 to purchase the lender for a knockdown worth of three billion Swiss francs ($3.32 billion) and as much as 5 billion francs in assumed losses in a rescue Swiss authorities orchestrated to stop a collapse in buyer confidence from pushing Switzerland’s no. 2 financial institution over the sting.

On Friday, UBS struck an settlement with the Swiss authorities on the circumstances of a 9 billion Swiss franc ($10 billion) public backstop for losses from winding down components of Credit Suisse’s business.

UBS sealed the deal in lower than three months – a good timetable given its scale and complexity – to supply higher certainty for Credit Suisse shoppers and staff and stave off departures.

UBS and the Swiss authorities have supplied assurances that the takeover will repay for shareholders and won’t burden the taxpayer. They say the rescue was additionally obligatory to guard Switzerland’s standing as a monetary middle, which might endure if Credit Suisse’s collapse triggered a wider banking disaster.

Myths debunked

However, the deal, which noticed the state bankroll the rescue, exploded two myths – particularly, that Switzerland was totally predictable and secure and that banks’ issues wouldn’t rebound on the taxpayers.

“It was supposed to be the end of too-big-to-fail and state-led bailout,” mentioned Jean Dermine, Professor of Banking and Finance at INSEAD, including that the episode confirmed this central reform after the worldwide monetary disaster had not labored.

Arturo Bris, Professor of Finance and Director of the IMD World Competitiveness Center, mentioned the rescue additionally the rescue confirmed that even massive world banks had been susceptible to bouts of financial institution panic that would not get resolved inside days.

UBS is ready to ebook a large revenue in second-quarter outcomes on Aug. 31 after shopping for Credit Suisse for a fraction of its so-called honest worth.

Ermotti has, nonetheless, warned the approaching months might be “bumpy” as UBS will get on with absorbing Credit Suisse, a course of UBS has mentioned will take three to 5 years.

Presenting the primary snapshot of the brand new group’s funds final month, UBS underscored the excessive stakes concerned, by flagging tens of billions of {dollars} of potential prices – and advantages, but in addition uncertainty surrounding these numbers.

Since the worldwide monetary disaster, many banks have pared again their world ambitions in response to harder rules.

The disappearance of Credit Suisse’s funding financial institution, which UBS has mentioned it’s going to search to chop again considerably, marks one more retreat of a European lender from securities buying and selling, which is now largely dominated by U.S. corporations.

Next problem

Possibly the primary problem for Ermotti, introduced again to steer the merger, might be a politically fraught resolution about the way forward for Credit Suisse’s “crown jewel” – the financial institution’s home business.

Bringing it into UBS’s fold and mixing the 2 banks’ largely overlapping networks may produce vital financial savings and Ermotti has indicated that as a base state of affairs.

But UBS has mentioned it’s contemplating all choices because it might want to weigh that in opposition to public strain to protect Credit Suisse’s home business with its personal model, id and, critically, workforce.

Analysts say public issues the brand new financial institution might be too massive – with a steadiness sheet roughly double the dimensions of the Swiss economic system – means UBS may must tread fastidiously to keep away from being uncovered to even harder regulation and capital necessities that its new scale would name for.

They additionally warn that uncertainty inevitably brought on by a takeover of such scale can depart UBS struggling to retain employees and clients. It remained an open query whether or not the deal can ship worth for shareholders in the long term.

Source: www.dailysabah.com