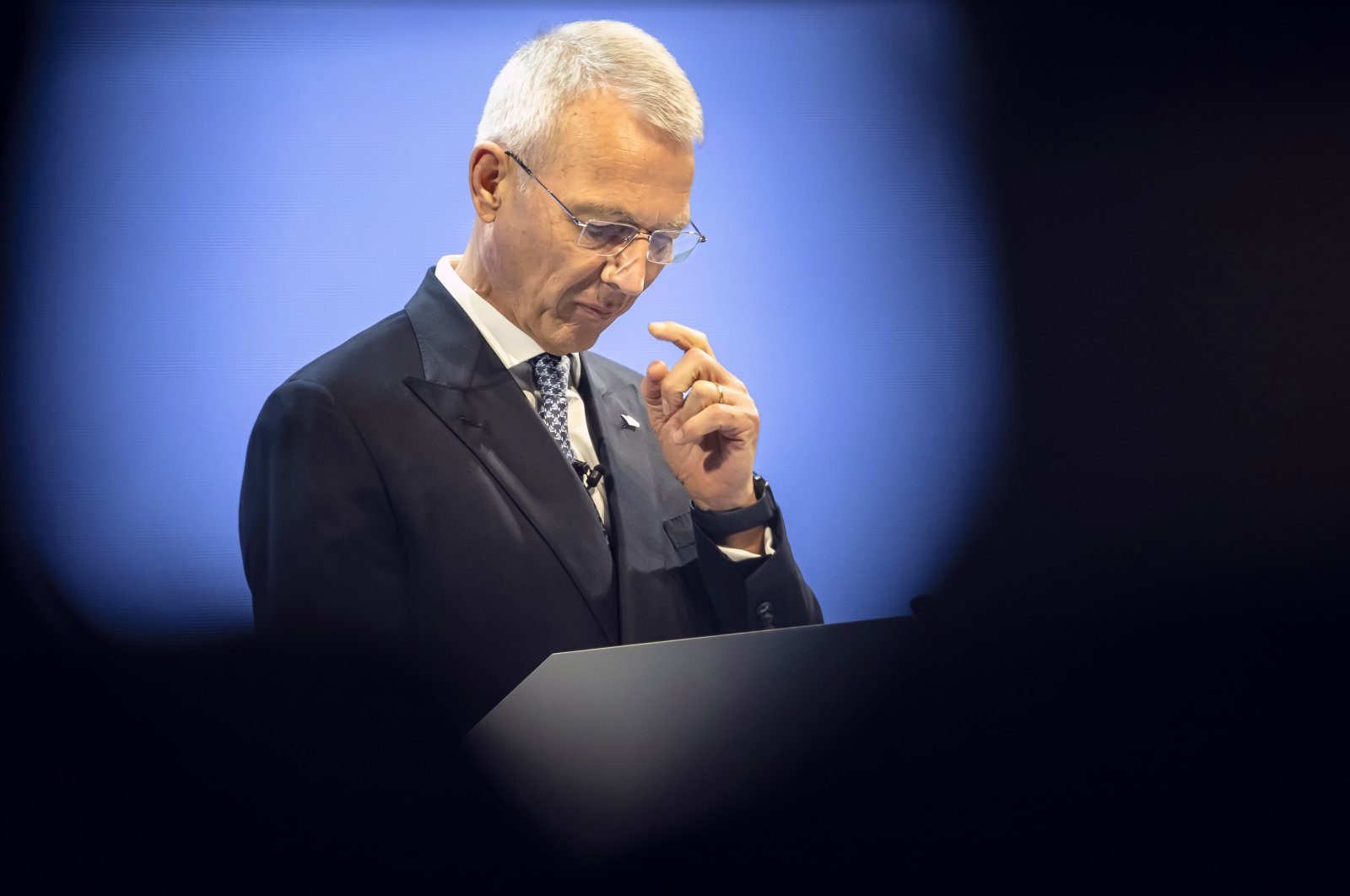

The chairperson of Credit Suisse stated Tuesday he was “truly sorry” as he apologized to shareholders for the failures of the once-venerable financial institution, acknowledging the shock and anger felt because the troubled Swiss lender is about to be swallowed up by rival UBS in a government-arranged takeover.

The unexpectedly organized takeover, for which Switzerland invoked emergency laws, bypassed Credit Suisse shareholders, who would in any other case have had a say, and all however wiped them out.

Axel Lehmann, who took the highest board job solely final yr after becoming a member of Credit Suisse from UBS in 2021, decried “massive outflows” of buyer funds in October and a “downward spiral” that culminated the earlier month as a U.S. banking disaster unleashed international turmoil.

Lehmann apologized, saying he had run out of time to show the financial institution round, regardless of his perception “until the beginning of the fateful week” that it may survive.

“I am truly sorry,” he stated. “I apologize that we were no longer able to stem the loss of trust that had accumulated over the years and for disappointing you.”

“The bank could not be saved,” he burdened, and solely two choices awaited – a deal or chapter.

“The bitterness, anger and shock of those who are disappointed, overwhelmed and affected by the developments of the past few weeks are palpable,” Lehmann advised what is probably going the final Credit Suisse shareholder assembly in its 167-year historical past.

It marks an ignominious finish to the financial institution based by Alfred Escher, a Swiss magnate affectionately dubbed King Alfred I, who helped to construct the nation’s railways after which the financial institution.

Protesters, together with some hoisting a ship labeled “Crisis Suisse,” gathered outdoors the Zurich hockey area internet hosting the annual normal assembly and shareholders voiced their anger as they bought their final crack at managers following a collapse of the financial institution’s inventory value during the last decade and an impending merger engineered to sidestep investor approval.

One by one, shareholders and workers stepped to a podium to put out their grievances and ask questions. One sought a exact itemizing of belongings beneath administration, one other blasted “bonus mania,” and one used a metaphor from Christianity to ask, “When is enough, repeatedly enough?”

Yet one other held up walnuts as props, saying, “A bag of these is worth about one share.” One younger investor took off his shirt to disclose a T-shirt with the phrases “Stop the Swindle” written in purple.

For the hundreds within the cavernous area, many retirees, the speeches had been usually met with well mannered applause and some bursts of laughter.

Shareholder Guido Röthlisberger stated he wore a purple tie “to represent that I and plenty of others today are seeing red.”

“I rather feel that I’ve been cheated by these institutions,” he stated.

Swiss authorities officers unexpectedly orchestrated the $3.25 billion takeover of Credit Suisse by UBS two weekends in the past after Credit Suisse’s inventory plunge intensified and extra jittery depositors pulled their cash. Political leaders, monetary regulators, and the central financial institution feared a teetering Credit Suisse may additional roil international monetary markets following the collapse of two U.S. banks.

Shareholders didn’t get to vote on the deal after the federal government handed an emergency ordinance to bypass the step. Instead, some got here to the annual assembly to listen to managers clarify what went incorrect.

“The whole thing – how this happened – makes me a little bit angry,” stated shareholder Markus Huber, 56, as he lined as much as attend his first Credit Suisse annual gathering.

Huber, self-employed in handyman providers, suspected authorities officers and financial institution leaders cooked up the deal “in secrecy” and stated there ought to have been better transparency.

Shareholders felt “a little bit astonished that there hadn’t been warnings out before,” he stated.

The takeover, nevertheless, isn’t on the docket for the shareholders’ assembly, the primary held in particular person in 4 years due to the COVID-19 pandemic. Instead, the pared-down agenda consists of dialogue on points like a dividend of about 5 cents per share, the reelection of the board, and granting a type of approval to managers for many of their actions working the financial institution.

Credit Suisse swooned from scandal to scandal lately: Bad bets on hedge funds, accusations of not reporting secret offshore accounts held by rich Americans to keep away from paying U.S. taxes, failing to do sufficient to stop cash laundering by a Bulgarian cocaine ring.

On Monday, the Swiss federal prosecutor’s workplace introduced it had opened a probe into occasions surrounding Credit Suisse forward of the UBS takeover. Executives hope the deal will shut within the coming months however acknowledged a fancy transaction.

A few dozen activists, together with one carrying a masks of the pinnacle of the Swiss central financial institution, took parting pictures at Credit Suisse: Some held indicators decrying the financial institution’s ties to Mozambique, the place the lender was discovered to have violated anti-money-laundering guidelines that led to almost $700 million in settlements to British and U.S. authorities.

Environmentalists, in the meantime, lashed out at Credit Suisse’s investments in oil and pure fuel – a longstanding grievance.

For Credit Suisse traders, the takeover deal has meant losses. Shareholders collectively will get 3 billion francs within the mixed firm, whereas traders holding about 16 billion francs ($17.3 billion) in higher-risk Credit Suisse bonds had been worn out.

Typically, shareholders face losses earlier than these holding bonds if a financial institution goes beneath.

Swiss regulators defended the transfer, saying contracts present the bonds may be written down in a “viability event.” Regulators will maintain a news convention Wednesday.

On Monday, international legislation agency Quinn Emanuel stated bondholders have employed the agency to “represent them in discussions with Swiss authorities and possible litigation to recover losses.”

Source: www.dailysabah.com