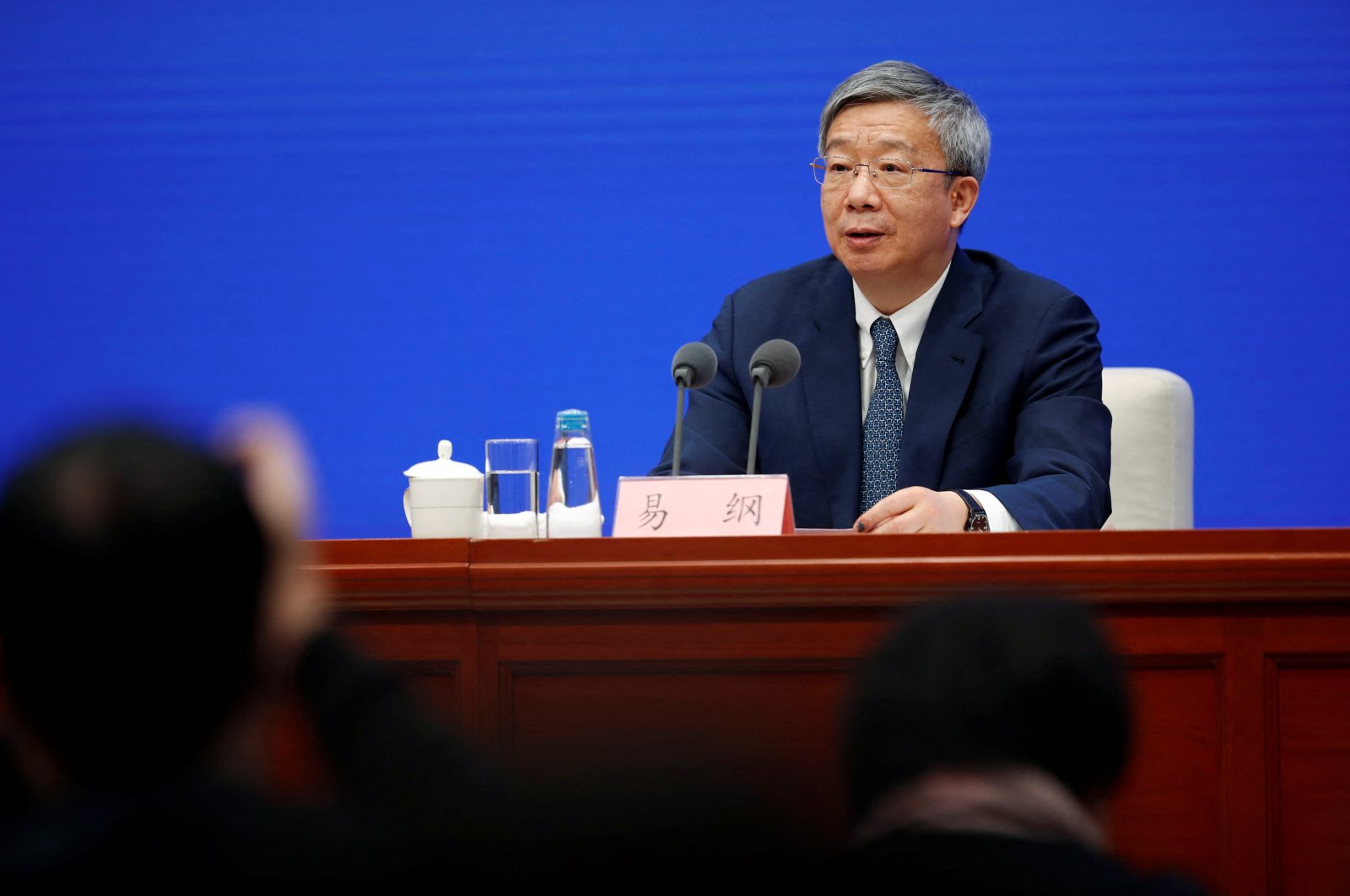

China reappointed Yi Gang as head of the central financial institution in a shock transfer on Sunday, because the nation appointed a Cabinet targeted on preventing financial headwinds.

The transfer goals to reassure entrepreneurs and monetary markets by exhibiting continuity on the high. At the identical time, different financial officers change throughout a interval of uncertainty on the earth’s second-largest financial system.

The reappointment of Yi, whose official title is governor of the People’s Bank of China (PBOC), got here towards expectations that retirement-age officers would step down.

Yi performs no position in making financial coverage, not like his counterparts in different main economies.

His official duties lie in “implementing monetary policy” or finishing up selections made by a policymaking physique whose membership is a secret.

But the central financial institution governor acts as spokesperson for financial coverage, is essentially the most outstanding Chinese determine in international finance, and is answerable for reassuring bankers and traders at a time when China’s financial system is rising from drastically slower progress.

At the March 5 opening of the annual session of China’s rubber-stamp parliament, the National People’s Congress, China introduced plans for a consumer-led revival of the struggling financial system, setting this 12 months’s progress goal at “around 5%.”

Last 12 months’s progress fell to three%, the second-weakest stage since not less than the Nineteen Seventies, placing the president and head of the ruling Communist Party, Xi Jinping, underneath unprecedented stress to revitalize the financial system.

A longtime veteran of financial coverage departments, Yi was first appointed governor of the People’s Bank of China in March 2018, taking up from the extremely regarded Zhou Xiaochuan.

Before turning into governor, Yi spent 20 years on the central financial institution after getting his Ph.D. from the University of Illinois and dealing as a professor of economics at Indiana University from 1986 to 1994.

He can also be a co-founder and professor at Peking University’s China Center for Economic Research.

The occasion determined to go for continuity in 2013, when then-PBOC governor Zhou, who already had been within the job for a decade, stayed on as governor whereas all different financial regulators modified.

Yi’s reappointment got here on the congress’s penultimate day, which additionally noticed Xi loyalists appointed as finance minister and head of the Cabinet planning company to hold out a program to tighten management over entrepreneurs, scale back debt dangers and promote state-led expertise improvement. In addition, incumbent Wang Wentao was reappointed minister of commerce.

The Congress additionally named 4 vice premiers who could also be in line for greater workplace. They embrace the sixth-ranking member of the occasion’s omnipotent Politburo Standing Committee, Ding Xuexiang, as vice premier overseeing administrative issues. In addition, veteran bureaucrats He Lifeng, Zhang Guoqing, and Liu Guozhong had been additionally named to the publish. Liu and Zhang had been incumbents.

Foreign Minister Qin Gang was additionally appointed to the place of state councilor, a place additionally held by Wang Yi, his predecessor and present superior, as director of the occasion’s Office of the Central Foreign Affairs Commission.

Defense Minister Li Shangfu, an aerospace engineer by coaching, was additionally named one of many 5 state councilors, together with Minister of Public Security Wang Xiaohong and Secretary General of China’s Cabinet, often called the State Council, Wu Zhenglong. Shen Yiqin was the one girl named to the place and was China’s highest-ranking feminine politician.

No ladies sit on the 24-member Politburo or its Standing Committee, and the occasion’s more-than-200-member Central Committee is 95% male.

Finance officers will prioritize managing company and family debt that Beijing worries have risen to harmful ranges. Tighter debt controls triggered a droop in China’s huge actual property trade in 2021, including to the COVID-19 pandemic’s downward stress on the financial system.

At the identical time, the ruling occasion is making an attempt to shift cash into expertise improvement and different strategic plans. That has prompted warnings an excessive amount of political management over rising industries may waste cash and hamper progress.

Xi has favored selling officers who typically lack the expertise of their predecessors and publicity to international trade and finance markets. That displays Xi’s effort to purge the Chinese system of Western affect and promote homegrown methods.

Source: www.dailysabah.com