Fintech startup Midas, which introduced retail investing to thousands and thousands in Türkiye, introduced Monday that it raised $45 million (TL 1.47 billion) in fairness funding, permitting it to increase the scope of providers and roll out new merchandise.

The funding is dubbed the biggest Series A fundraising by a Turkish fintech and the second-largest throughout sectors. It comes lower than three years after Midas was launched.

The spherical was led by Portage, with participation from the International Finance Corporation (IFC), Spark Capital, the Earlybird Digital East Fund and Revo Capital, doubling down on their earlier funding within the firm’s $11 million seed spherical in 2022.

The new capital will permit Midas to increase and roll out three new merchandise: cryptocurrency buying and selling, mutual funds and financial savings accounts.

Since Midas launched in 2021, it has opened up Türkiye’s retail funding market to greater than 2 million customers. Previously, customers confronted onerous transaction charges and excessive minimal stability necessities, typically as much as $25,000, to entry U.S. shares.

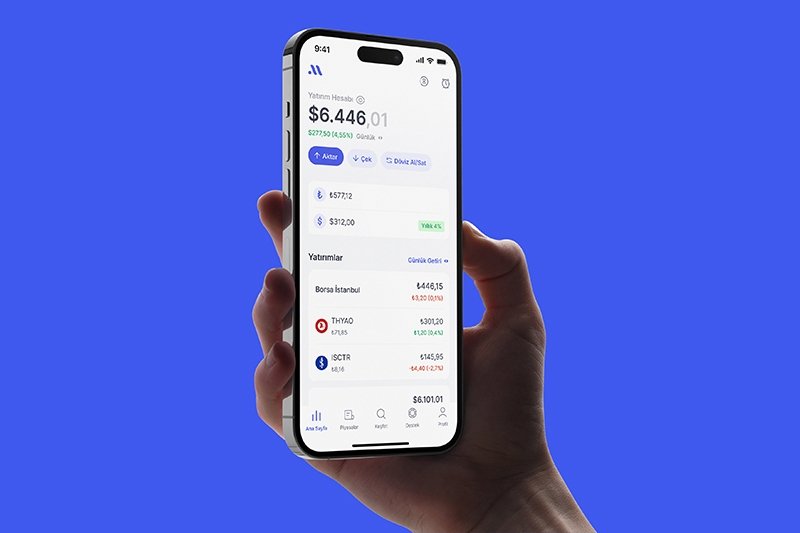

Midas is the primary firm to supply quick, seamless entry to Turkish and U.S. equities with low fee charges by way of its app.

It has additionally invested closely in educating the market by producing easy-to-digest monetary content material without spending a dime. These embrace real-time inventory market information and news, detailed firm profiles, in-depth documentaries, a each day podcast, and a weekly publication to assist traders navigate the markets.

In doing so, it pioneers Türkiye’s most complete localized monetary content material choices for traders.

The new funding will permit Midas to develop its providing, together with entry to mutual funds, an interest-generating financial savings product, and cryptocurrency buying and selling.

Midas additionally initiatives that it’s going to increase past Türkiye within the subsequent two to 5 years, with plans to focus on nations in rising markets.

The increase additionally comes amid a worldwide stagnation in fintech investments within the final two years, indicating continued investor confidence in Midas’ technique of disrupting the market by prioritizing the shopper expertise above all and always bettering its funding product’s usability and low value.

Amid the news of Midas report funding, Nasdaq congratulated the fintech agency on a large display at Times Square in New York.

Egem Eraslan, CEO and founding father of Midas, stated: “We are delighted to announce our Series A fundraise, which is the biggest ever by a Turkish fintech. Just a few years ago, Türkiye did not have a strong investing culture and the market was stagnant, but thanks to Midas, that is changing.”

“We have already brought affordable, quick access to U.S. and Turkish equities to millions of people in Türkiye.”

“This fundraising will allow us to expand our product suite further, with mutual funds, savings products and cryptocurrency trading firmly in our sights. Longer term, we want to broaden our horizons and expand our geographic footprint beyond Türkiye to become a prominent regional player,” he added.

Paul Desmarais III, co-founder of Portage and CEO and chairperson of Sagard, commented: “Midas is leading a wave of transformation within Türkiye’s financial landscape.”

“Globally, Portage invests in transformational financial technology, and Midas is poised to lead that initiative in a region of early adopters. We are very pleased to participate in Midas’s development and to support this ambitious team in bringing financial inclusion and access to wealth-building tools to the Turkish people.”

The increase may even assist Midas double its headcount. It presently has a workforce of 210 folks working from its workplace in Istanbul, which is already triple the variety of workers in 2022.

“We have a long-term view for this company, and short-term market conditions have not hindered that. The raise comes as a significant vote of confidence in our mission to transform investing in the region,” Eraslan famous.

According to info obtained from the corporate, the appliance and approval processes for the funding are ongoing with the Capital Markets Board (SPK) and the Competition Board (RK). When accomplished, the required bulletins shall be revealed on the Public Disclosure Platform (KAP) and the Türkiye Trade Registry Gazette (TTSG).

Source: www.dailysabah.com