A possible debt default prompted by failure to boost the U.S.’ debt ceiling would have “very serious repercussions” for the nation’s economic system in addition to the worldwide economic system, together with probably increased borrowing prices, the International Monetary Fund (IMF) warned on Thursday.

IMF spokesperson Julie Kozack additionally advised a news briefing that authorities wanted to remain vigilant on new vulnerabilities within the U.S. banking sector, together with in regional banks, that might emerge within the adjustment to a a lot increased rate of interest atmosphere.

Kozack stated the IMF couldn’t instantly quantify the impression {that a} U.S. default would have on international progress.

The Fund in April forecast international gross home product (GDP) progress at 2.8% for 2023, however stated that deeper monetary market turmoil, marked by a extreme pullback in asset costs and sharp cuts in financial institution lending, may slam output progress again to 1%.

But she stated increased rates of interest may very well be one results of a U.S. default and a few broader instability within the international economic system.

“We would want to avoid those severe repercussions,” Kozack stated. “And for that reason, we again are calling on all of the parties to come together, reach consensus and resolve the matter as quickly as possible.”

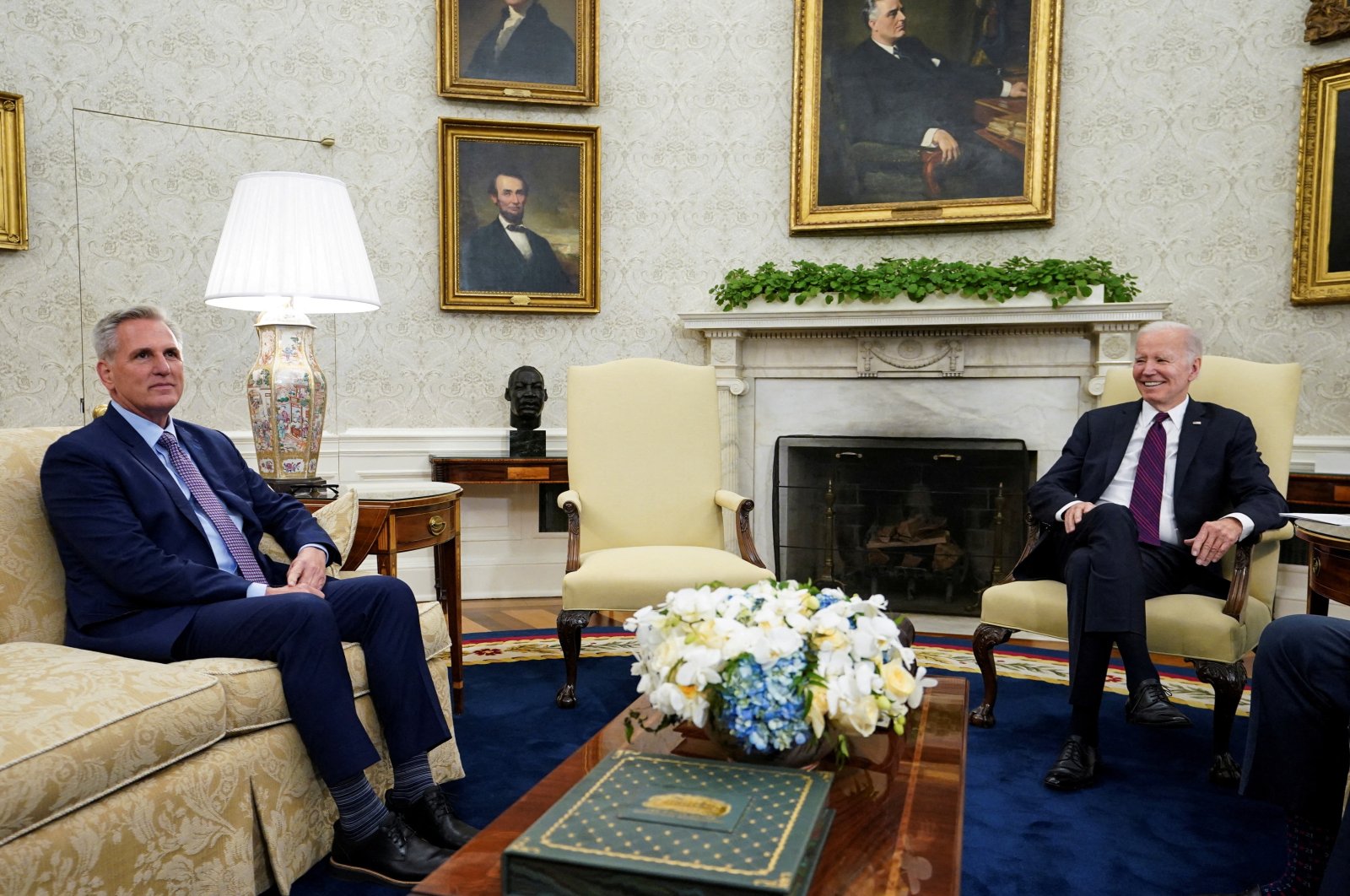

Detailed talks on elevating the U.S. authorities’s $31.4 trillion debt ceiling kicked off on Wednesday with Republicans persevering with to insist on spending cuts, a day after Democratic President Joe Biden and high congressional Republican Kevin McCarthy met on the problem for the primary time in three months.

U.S. Treasury Secretary Janet Yellen has warned {that a} default on U.S. funds may come as early as June 1 if Congress fails to boost the borrowing cap.

Regarding turmoil within the U.S. banking sector, Kozack stated the IMF has welcomed the “decisive” actions by regulators and coverage makers to comprise the failures of three main regional U.S. lenders in current weeks.

Kozack added that the Fund will quickly conduct its “Article IV” annual assessment of U.S. financial insurance policies, and that evaluation, to be issued in the direction of the tip of May, will analyze the impression of pressures on regional banks, together with any tightening of credit score situations.

usechatgpt init success

usechatgpt init success

Source: www.dailysabah.com