Australia’s central financial institution on Tuesday surprised markets by elevating its money charge 25 foundation factors when merchants had regarded for an prolonged pause, saying inflation was means too excessive and warned that even additional tightening could also be wanted to carry it to heel.

The unambiguously hawkish coverage stance despatched the Australian greenback hovering and bond futures tumbling as markets rapidly lifted the height for rates of interest.

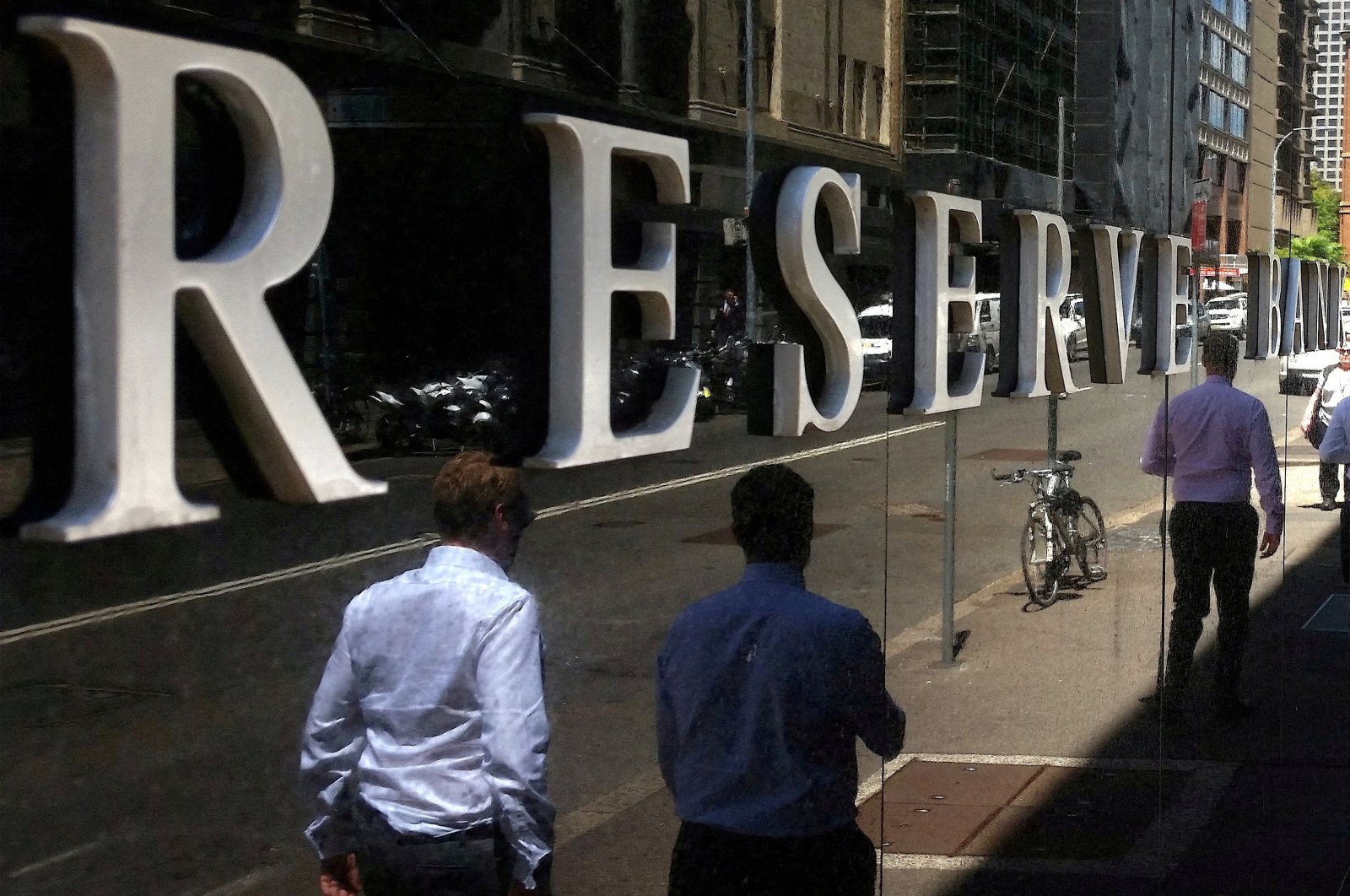

Wrapping up its May coverage assembly, the Reserve Bank of Australia (RBA) raised charges to three.85% and stated “some further tightening” could also be required to make sure that inflation returns to focus on in a “reasonable timeframe.”

The money charge now sits at its highest since early 2012, bringing the full RBA hikes in its worth battle to a whopping 375 foundation factors since May final yr – the quickest tightening marketing campaign within the nation’s trendy historical past.

Markets, in addition to a majority of analysts, had been wagering closely on a gentle final result given core inflation had eased slightly greater than anticipated and the RBA had stated at its earlier coverage assembly that the total ache of the previous tightening was but to be felt within the economic system.

The Australian greenback shot up by 1.3% to AU$0.6715, whereas three-year futures dived 15 ticks to 96.770.

Futures slid because the market priced within the new 3.85% charge and implied round a 60% likelihood charges may attain 4.10% by August.

“Inflation in Australia has passed its peak, but at 7% is still too high and it will be some time yet before it is back in the target range,” stated Governor Philip Lowe, noting the upside dangers in providers inflation and rising labor prices.

“Given the importance of returning inflation to target within a reasonable timeframe, the board judged that a further increase in interest rates was warranted today.”

Inflation nonetheless sticky

The much-watched first quarter client costs information final week confirmed that inflation was easing from 33-year highs. However, even after bearing in mind Tuesday’s hike, it’s nonetheless projected to return to three% – the highest of the RBA’s goal band of 2-3% – in mid-2025, based on the central financial institution’s newest forecasts.

Inflation is now anticipated to gradual to 4.5% this yr, in contrast with the earlier forecast of 4.75%.

“This is an awfully long time for inflation to exceed target, and runs the risk that higher inflation expectations will become embedded,” stated Sean Langcake, head of Macroeconomic Forecasting for BIS Oxford Economics.

“This would ultimately lead to even higher interest rates, which the bank is looking to avoid as it seeks to keep some momentum in the economy.”

Lowe stated the hike on Tuesday would assist anchor medium-term inflation expectations.

Both ANZ and Nomura penciled in one other quarter-point charge hike for August.

However, Gareth Aird, head of Australia economics at Commonwealth Bank of Australia who accurately tipped Tuesday’s enhance, expects the necessity for additional tightening to dissipate from right here, saying previous tightenings will tamp down on client spending and inflation.

Australia’s battle towards inflation mirrors a worldwide marketing campaign by policymakers nervous that red-hot costs would do longer-lasting financial harm if not rapidly contained.

On Wednesday, the U.S. Federal Reserve is extensively anticipated to lift rates of interest once more, by 25 foundation factors, whereas the European Central Bank may even shock with an outsized half-point enhance a day later.

Recession dangers

The labor market remained tight, with web employment blowing previous expectations in March and the jobless charge hovering at close to 50-year lows.

A surge in migration, which may raise inhabitants development to a heady 2% this yr, is fuelling will increase in rents and including to inflationary pressures.

Also on Tuesday, the RBA lowered the financial development forecast for this yr to 1.25%, from 1.5% beforehand, whereas projecting the unemployment charge to extend to round 4.5% in mid-2025.

Governor Lowe will communicate tonight at 9.20 a.m. native time (11.20 p.m. GMT) to elucidate the board’s pondering behind the shock hike and reply questions from the viewers.

Shane Oliver, chief economist at AMP, warned of the financial dangers from any additional coverage tightening.

“We think that the RBA has done more than enough and we have reached the peak in rates. Continuing to raise rates from here adds to the rising risk of plunging the economy into a recession.”

Source: www.dailysabah.com