Global financial policymakers are focusing squarely on inflation and the necessity to proceed elevating rates of interest to tame it, regardless of broad warnings in regards to the financial dangers posed by latest stress within the banking sector.

The name for warning has come from high officers on the International Monetary Fund (IMF) who’re apprehensive a couple of world crack-up, from bond markets flashing recession indicators, and from policymakers themselves who say they’re monitoring the small print of banking information and the temper of business executives for indicators of bother.

Still, three of the world’s 4 main central banks are on observe to lift rates of interest once they subsequent meet, a step U.S. markets guess will set the stage for cuts in borrowing prices quickly after as recession arrives.

In their newest World Economic Outlook, IMF officers Tuesday trimmed their forecast for world development however stated there have been “plausible” eventualities, flowing from the latest failures of Silicon Valley Bank and Signature Bank within the U.S. and the compelled merger of Credit Suisse, that might reduce development even deeper. At the identical time, extra extreme banking issues and tighter credit score might depart the worldwide economic system stalled altogether.

In distinction, regardless of the latest monetary stress, financial policymakers appear primed to do extra to fight excessive inflation that they nonetheless view because the higher danger.

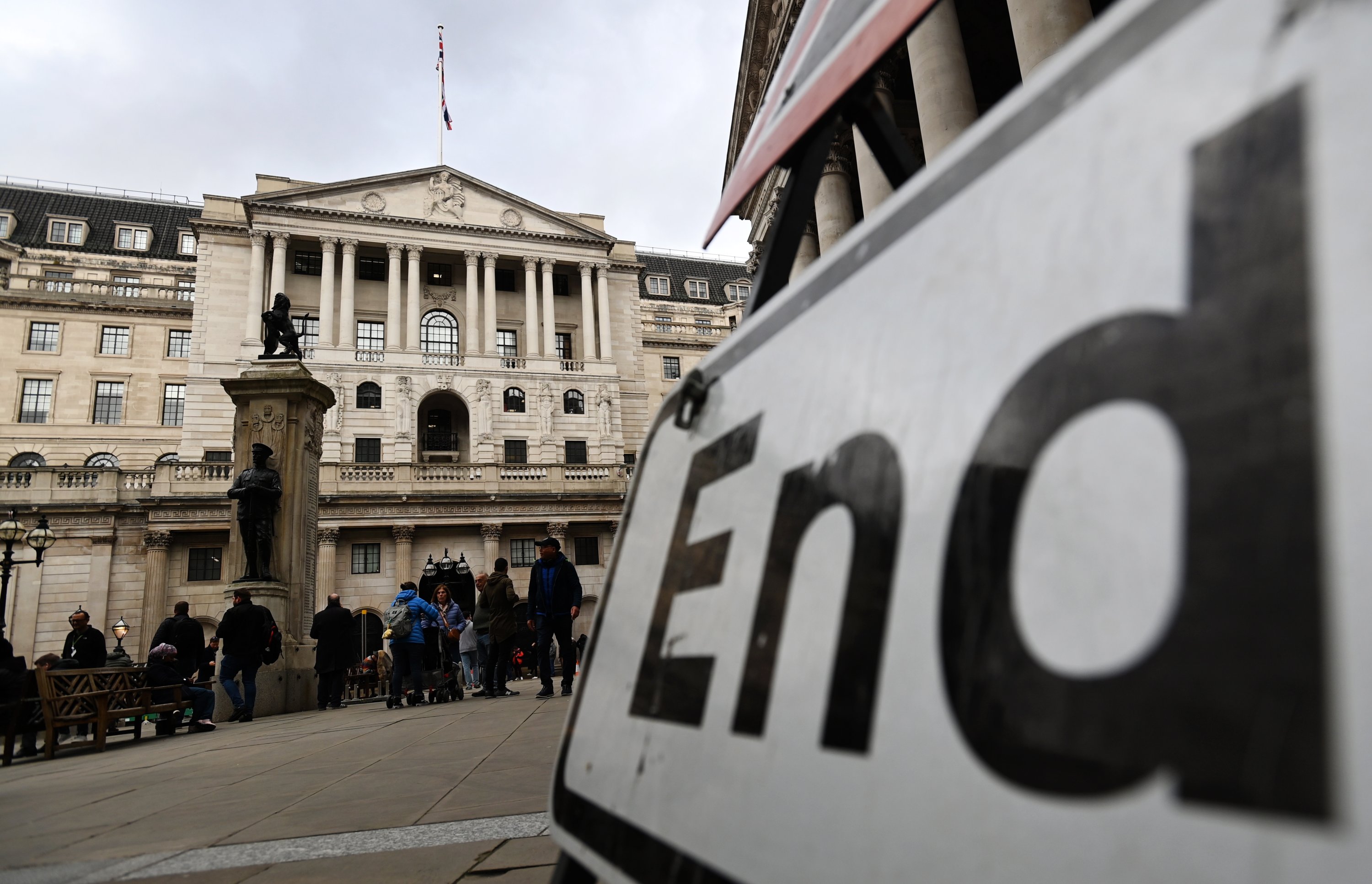

“The onus remains on ensuring enough monetary tightening is delivered to ‘see the job through’ and sustainably return inflation to target,” Huw Pill, the Bank of England’s (BoE) chief economist, stated final week, warning that inflation dangers had been “skewed significantly to the upside.”

Though headline inflation within the United Kingdom was set to drop from above 10%, the best fee within the developed world, Pill stated the “potential persistence of domestically generated inflation” remained a barrier to reaching the two% goal.

An analogous dilemma is rising in Europe and the U.S., elements of the world that share a 2% inflation objective and a way that the underlying tempo of value will increase has gotten caught at a degree a lot greater than that.

The outlier stays Japan, the place long-stagnant inflation and wage development are solely now exhibiting budding indicators of change. In his inaugural news convention on Monday, Bank of Japan Governor (BOJ) Kazuo Ueda harassed the necessity to maintain an ultra-loose financial coverage to assist sustainably obtain a 2% inflation goal.

Nothing ‘damaged’ but

International financial officers gathering in Washington this week for the IMF and World Bank spring conferences can take some consolation that pandemic-era dangers are persevering with to decrease.

The COVID-19 well being disaster has eased, with commerce largely again to regular. What appeared an incipient world recession simply months in the past has given strategy to continued, if gradual, development, even within the eurozone, the place output had appeared on the verge of shrinking.

An aggressive yr of central financial institution fee hikes hasn’t but “broken” any of the economies concerned, with the U.S. unemployment fee at 3.5%, close to its lowest degree because the late Sixties. Even if borrowing prices are set to extend, the tightening cycle is probably going nearing its finish as officers zero in on a degree they really feel is sufficiently restrictive to drag inflation into line.

Still, that terminal fee stays unclear. The finish of synchronized tightening by the Federal Reserve (Fed), BoE, and European Central Bank (ECB) doesn’t suggest tight financial coverage goes away, removed from it. On the opposite, central bankers have begun to concede a key level: A normalizing world economic system will not foster a simple return to the pre-pandemic period’s low inflation traits.

Developments that policymakers thought would get them far alongside that highway, such because the restore of world provide chains, have taken place as anticipated. But the assist in reducing inflation has been lower than anticipated, primarily confined to slowing value will increase for items. Moreover, value pressures for providers have proven little moderation.

‘Entrenched’ inflation

In Europe, after dodging recession and weathering a winter with lower-than-anticipated vitality costs regardless of the warfare in Ukraine, inflation issues have moved from the oil-driven headline fee to an array of “core” costs that maintain rising.

Wages, providers and meals drive value development to the place the ECB’s consideration has shifted virtually solely to underlying inflation on fears that fast value development is susceptible to getting caught above goal.

Philip Lane, the ECB’s usually cautious chief economist, even put a number of fee hikes on the desk as core inflation peaked at 5.7% final month. However, general inflation is sort of 4% factors under its October peak.

“Under our baseline scenario, to make sure inflation comes down to 2%, more hikes will be needed,” Lane stated within the German newspaper Die Zeit on March 29.

A U.S. measure usually cited by Fed officers, the “trimmed mean” inflation fee excluding items with probably the most vital and minor value actions, has proven slight enchancment, from 4.75% in August to simply 4.59% in February.

The U.S. Central Bank is predicted to extend its benchmark in a single day rate of interest by one other quarter of a share level subsequent month and sign whether or not extra hikes could also be warranted. The U.S. labor market stays sturdy, with inflation now targeted in sectors which might be each probably the most labor-intensive and, by some analysis, the least delicate to greater charges – dangerous news for the Fed and a dynamic that will drive charges greater.

TD Securities macro strategists Jan Groen and Oscar Munoz just lately concluded that a number of the pandemic-era inflation had turn into “entrenched,” with the U.S. private consumption expenditures value index, excluding meals and vitality prices, prone to get lodged at a fee round 3%.

If that “core” PCE fee, which the Fed intently screens, is as persistent as thought, they wrote, the U.S. Central Bank will “have to choose between its inflation target or aggressive easing” to cope with an eventual rise within the unemployment fee.

The probably final result, they stated, is that rates of interest will stay greater than anticipated as inflation continues to be the precedence.

The IMF’s chief economist, Pierre-Olivier Gourinchas, contends that focus is appropriately positioned given monetary stability dangers seem for now to have subsided.

“Is it causing potentially catastrophic financial instability further down the road and, as a result, should they sort of refrain from doing this?” he stated in an interview with Reuters on Tuesday. “Our assessment on this is not because the financial instability looks very contained.”

Moreover, not appearing sufficiently to include inflation could be “creating a problem of its own.”

Source: www.dailysabah.com