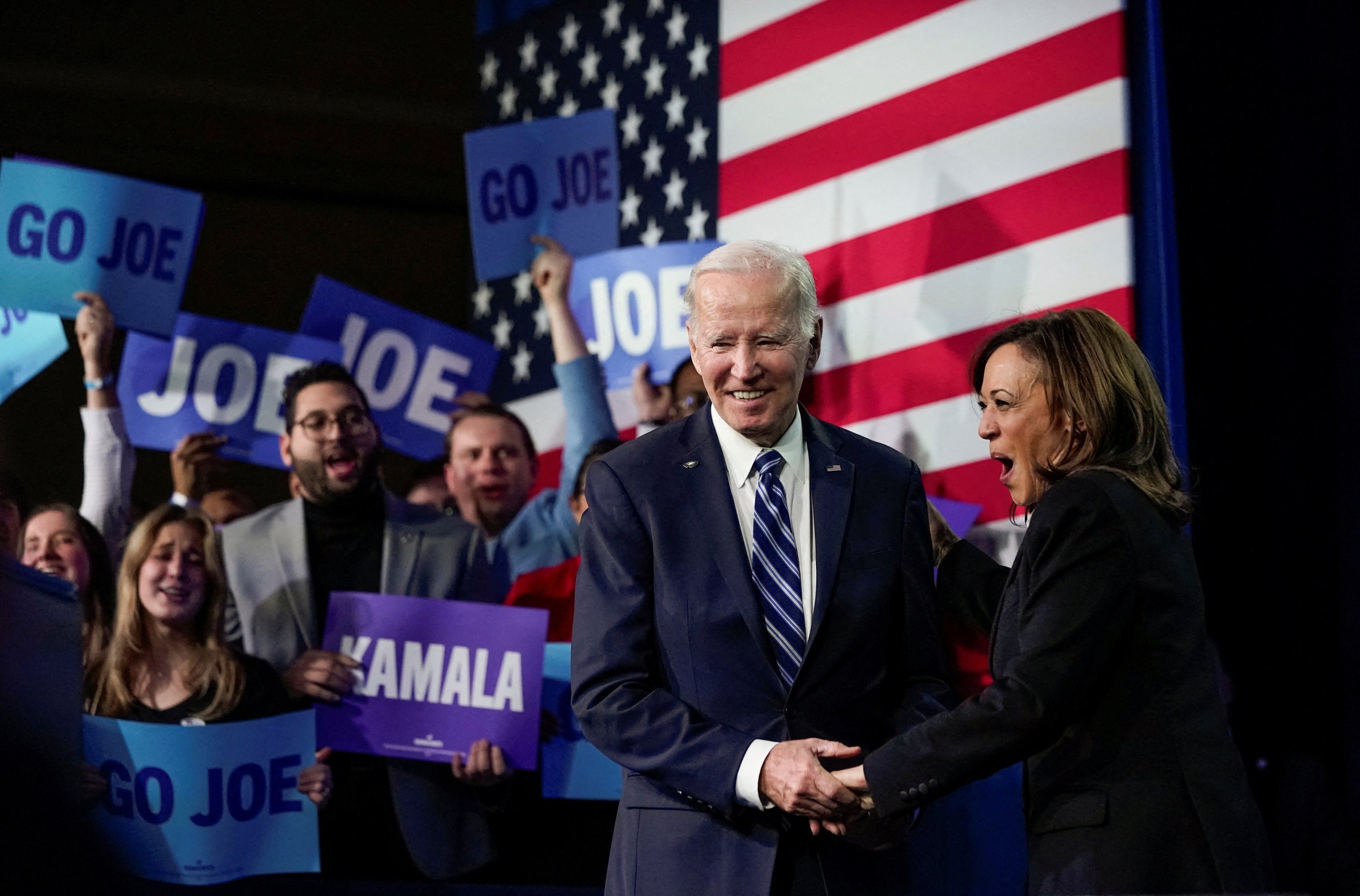

Going into Tuesday’s State of the Union deal with, U.S. President Joe Biden sees a nation with its future aglow.

Republicans have adopted a far bleaker view – that the nation is beset by crushing debt and that Biden is principally chargeable for inflation. And the GOP now holds a House majority intent on blocking the president.

The extra advanced actuality is that the United States is on a tightrope, making an attempt to stability efforts to cut back inflation with the necessity to keep upright and keep away from falling right into a recession. That’s with the seemingly inherent contradiction of the Federal Reserve’s rate of interest will increase and the unemployment price falling to a close to 54-year low.

Based on previous speeches, Biden believes the insurance policies adopted underneath his watch can fill the U.S. with new factories and defend towards local weather change. Roads, bridges, sewer programs, ports and web service could be improved. The center class could be extra financially safe. So would America’s place within the international financial system’s hierarchy.

The president stated the proof was within the January employment report on Friday. It confirmed 517,000 jobs had been added because the unemployment price fell to three.4%, making it “crystal clear” that his “chorus of critics” had been unsuitable.

“Here’s where we stand: The strongest job growth in history,” Biden stated. “Put simply; I would argue the Biden economic plan is working.”

Republicans are pushing again. They blamed Biden’s trillion-dollar-plus spending for prime inflation and surging fuel and meals costs. GOP lawmakers need to repeal his tax will increase and extra cash for the IRS. They oppose his forgiveness of scholar debt and blame him for the migrants searching for to enter the nation on the U.S.-Mexico border.

Neither aspect captures the fullness of the particular state of the financial system.

One group of consultants can learn the information and declare a recession is on the horizon. Different teams can deal with a separate set of figures and see the rationale to rejoice. It’s a disorienting second.

Biden can rejoice the low jobless price at the same time as Republicans bemoan inflation continues to be harmful.

“It’s the best of times and the worst of times for the U.S. economy, to borrow a phrase,” stated Mark Zandi, chief economist at Moody’s Analytics. “The economy is full of contradictions as it struggles to get beyond the massive global shocks of the pandemic and the Russian invasion of Ukraine.”

Zandi stated he expects the U.S. financial system will “skirt” a recession this yr, although many economists consider a downturn will come.

Gus Faucher, PNC Financial Services’ chief economist, pegs the chances of a recession this yr at 60%. But he stated any downturn could be “mild” as a result of “worker shortages will limit layoffs, consumer balance sheets are in great shape, the banking system is solid.”

Most individuals within the U.S. assume the nation is already in a recession, even when they really feel positive.

Only 24% of adults name the nationwide financial system good, and 76% say circumstances are poor, in line with a ballot by The Associated Press-NORC Center for Public Affairs Research. At the identical time, 57% say their monetary scenario is nice. That’s unchanged since December, however it has eroded barely since final yr when 62% felt optimistic about their funds.

The Fed’s essential drive shaping the financial system goals to maintain costs secure and inflation at round 2%. Yet, shopper costs jumped 6.5% final yr.

To carry down inflation, the Fed has tried to decelerate hiring and development by elevating its benchmark price over the previous yr. When Biden delivered the State of the Union Address in 2022, the Fed’s benchmark price was near-zero. It’s now over 4.5%, the quickest improve in 4 a long time, and Fed Chairman Jerome Powell stated Wednesday that the speed would seemingly go increased.

“Without price stability, the economy does not work for anyone,” Powell informed reporters after the Fed board’s most up-to-date assembly.

The Fed price will increase mark a big reversal in how the financial system operates.

Since the 2008 monetary disaster, the U.S. central financial institution has held its benchmark price close to historic lows to carry again development. That made it simpler for tech start-ups as a result of low-cost cash meant buyers anticipated them to deal with development as a substitute of income. In addition, shoppers acquired used to traditionally inexpensive charges for mortgages and auto loans.

The previous yr’s price jumps produced a sudden whiplash. The inventory market fell. Prominent tech corporations reminiscent of Google and Microsoft just lately introduced layoffs. Even as pc chip corporations started constructing new vegetation and crediting Biden’s insurance policies, the world financial system swung from a scarcity of semiconductors to a glut. Mortgage charges initially doubled to over 7% earlier than falling again to six% final week. The huge improve meant month-to-month funds turned unaffordable for would-be homebuyers, forcing many to remain in leases.

Glenn Kelman, CEO of the actual property brokerage Redfin, stated the housing market is extra strong than many anticipated. But the years of low charges worsened generational inequality. Baby boomers turned rich as their houses elevated in worth, however then charges jumped when extra millennials needed to purchase, they usually discovered themselves priced out.

“A generation ago, boomers owned 21% of U.S. wealth,” Kelman stated. “For millennials, that number is 7%. So they’re still on the outside looking in.”

Carl Tannenbaum, the chief economist for Northern Trust, stated he’s shocked that the speed will increase have hit housing however not employment. Traditional fashions assumed that efforts to decrease inflation would routinely embrace job losses. But when he talks to corporations, most are reluctant to fireside their employees as a result of companies had hassle discovering expert staff in the course of the pandemic.

“Because the supply of labor has been so starved for the past two years, firms are holding on to who they have,” Tannenbaum stated. “The prevailing wisdom is if we have a recession, it will be shallow. So firms are going to want to be ready to go.”

As a lot as Biden says his mission is about giving Americans confidence, his problem would possibly relaxation with an financial system through which few issues are sure.

When the pandemic hit in 2020, the federal government support was so overwhelming {that a} monetary market crash become a rally. Biden tried to guarantee the nation in 2021 that rising costs had been a brief inconvenience, solely to search out that inflation outlined what number of perceived his first two years as president. The expectation was that rate of interest will increase would in the end result in layoffs and better unemployment, however hiring stayed strong, indicating that the financial system is unmoored from conventional expectations.

If Biden faces a problem within the financial system, it would simply be that nobody is aware of what might occur subsequent.

“We’re in an environment where there is a lot of uncertainty,” stated Gregory Daco, chief economist at EY-Parthenon. “The conflicting signals we keep getting on the economy make it very hard to get an accurate pulse.”

Source: www.dailysabah.com