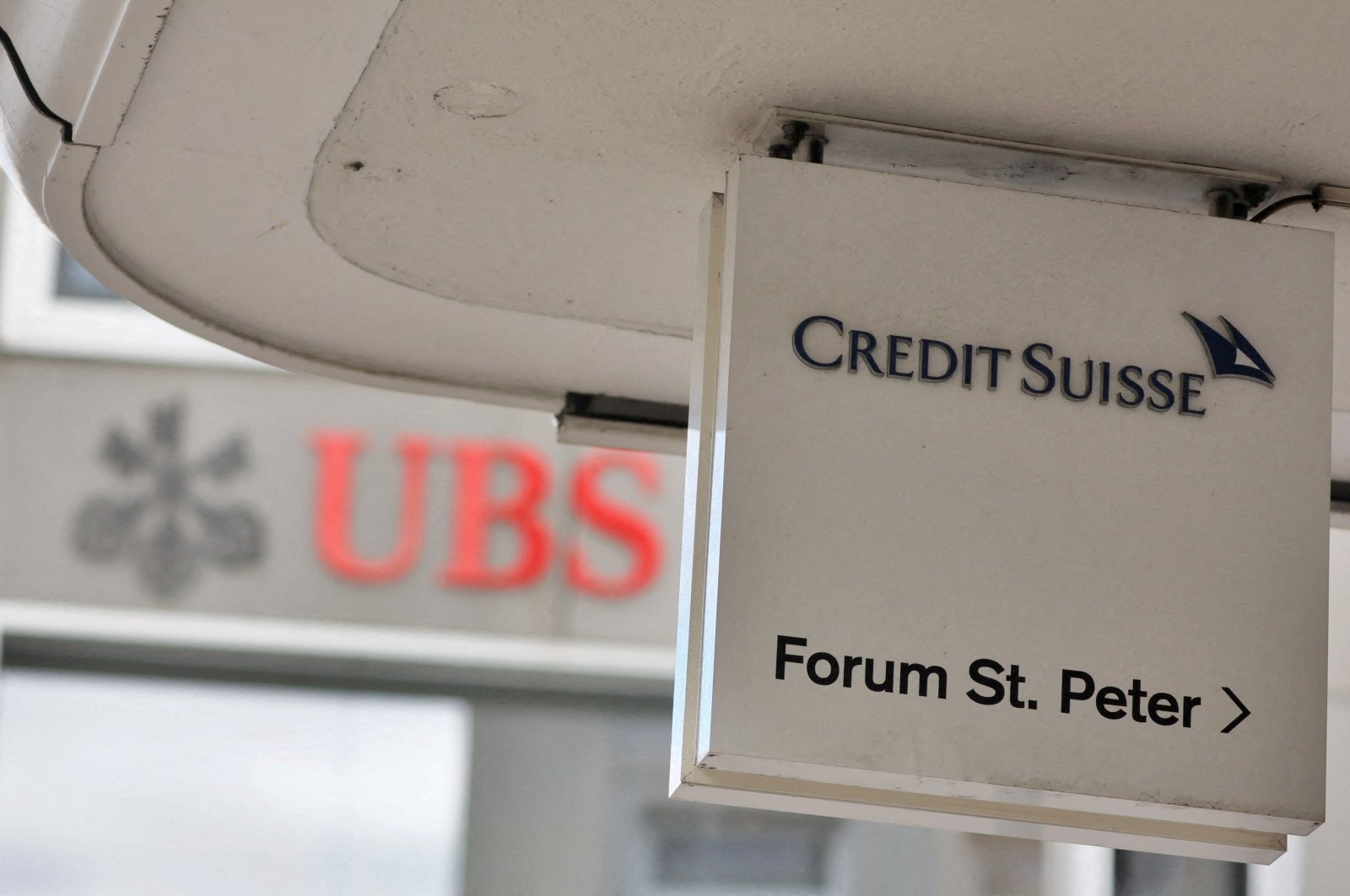

The merger between banks Credit Suisse and UBS may minimize as much as 36,000 jobs worldwide, the SonntagsZeitung weekly reported Sunday.

The Swiss authorities rapidly organized the takeover by UBS of Credit Suisse on March 19 to forestall a world monetary meltdown, following fears of contagion from the collapse of banks within the United States.

UBS introduced Wednesday it might carry again former chief government Sergio Ermotti to deal with the large dangers concerned within the Swiss banking large’s controversial absorption of its troubled rival Credit Suisse.

On Sunday, citing nameless inner sources, SonntagsZeitung stated administration was mulling chopping between 20% and 30% of the workforce, which means between 25,000 and 36,000 jobs.

According to the weekly, as much as 11,000 jobs could possibly be minimize in Switzerland alone, which didn’t present particulars of which posts could possibly be focused.

Before the merger, UBS and Credit Suisse had employed barely over 72,000 and 50,000 folks, respectively.

UBS and Credit Suisse, the second-biggest financial institution in Switzerland, had been among the many choose banks worldwide thought-about international systemically essential monetary establishments (G-SIFIs) and subsequently deemed too huge to fail.

UBS chairperson Colm Kelleher stated this week: “There’s a huge amount of risk in integrating these businesses.”

Credit Suisse was embroiled in a collection of scandals main as much as a March 15 share value collapse when investor confidence plunged following two financial institution failures within the U.S.

Among these had been the chapter of the British monetary firm Greensill and the implosion of the U.S. hedge fund Archegos.

It was additionally caught up in a bribery scandal involving loans to state-owned corporations in Mozambique. In addition, it was fined $2 million in a cash laundering case linked to a Bulgarian cocaine community.

Boardroom shake-up

Meanwhile, Norges Bank Investment Management will vote in opposition to the re-election of Credit Suisse Chair Axel Lehmann and 6 different administrators on the Swiss lender’s annual common assembly on Tuesday, the Norwegian wealth fund stated on its web site.

“Shareholders should have the right to seek changes to the board when it does not act in their best interest,” the Norges wealth fund stated forward of the April 4 assembly.

Besides Lehmann, Norges opposes the re-election of Credit Suisse administrators Iris Bohnet, Christian Gellerstad, Shan Li, Seraina Macia, Richard Meddings and Ana Pessoa.

Credit Suisse declined to remark, and UBS didn’t instantly reply to a request for remark.

Source: www.dailysabah.com