Artificial intelligence (AI) expertise has turn out to be a pervasive idea, impacting each sector globally. As expertise ventures try to innovate, they’re more and more leveraging AI expertise to its fullest extent.

The 12 months 2023 marked a big milestone within the enterprise capital sector, with AI corporations producing a staggering $50 billion in income. The funding pattern not solely mirrors the increasing maturity and potential of AI applied sciences but in addition lays the groundwork for ongoing innovation and progress within the years to come back.

Experienced enterprise capital funds, together with company enterprise capital funds, are inserting a big deal with AI expertise. TT Ventures, the enterprise capital arm of Türk Telekom, notably directed investments towards AI-focused ventures. Similarly, main non-public lender, Akbank, with a fund of $100 million, is monitoring AI expertise ventures not solely in Türkiye but in addition internationally. Simya VC, a world early-stage enterprise fund, invested a complete of $2.1 million in six startups in 2023, with AI expertise ventures prominently that includes amongst its investments.

Early-stage ventures

Preparing to ascertain its second fund in 2024, Simya VC goals to spend money on greater than 10 ventures this 12 months.

Established as a part of a collaboration of Türkiye’s first company enterprise capital fund, 212, Neo Portföy and Alchemist Accelerator, one of many world’s finest acceleration packages, to spend money on early-stage ventures, Simya VC held discussions with a complete of 280 startups final 12 months.

Out of those, it invested in notable startups similar to Agrotics in agricultural expertise, B2Metric in AI-supported information analytics, Evercopy in AI-based content material creation, Juphy in AI-based B2B software program as a service (SaaS), Syntonym in generative AI and Werover in renewable power.

Contributing to international growth

Selma Bahçıvanoğlu, managing accomplice at Simya VC, expressed satisfaction of their achievements, noting plans to ascertain their second fund in 2024. Emphasizing investments in ventures with international visions, Bahçıvanoğlu highlighted their partnership with Alchemist, enabling ventures to leverage assist for getting into the U.S. market and benefiting from its community impact.

“In a relatively short period of time, akin to a year, we established our first fund, invested in a total of six ventures and expanded our investor portfolio to 90. This achievement is tremendously pride-inducing for us. Within the year 2024, we plan to establish our second fund (Simya 2). With the funds we’ve set up, we aim to invest in over 10 ventures this year,” she famous.

Bahçıvanoğlu additionally emphasised their funding in globally-minded ventures.

“In immediately’s world, ventures mustn’t confine themselves to the native market. However, it is not simple for a enterprise to solely deal with a technique of promoting to the worldwide market. This is exactly the place the ventures in our portfolio, benefiting from the funding they obtain from Simya together with the assist of Alchemist, one of many world’s finest acceleration packages and our accomplice, come into play,” she stated.

“Alchemist offers assist for ventures getting into the U.S. market and contributes to them by means of its community impact, because of its know-how concerning the market.”

Investing in innovation

In 2023, Logo Ventures invested in 10 startups, rising its complete investments to 16 with six follow-on investments. Prioritizing ventures able to addressing future challenges, Logo Ventures opted for Figopara and Kamion, positioned to steer of their respective markets, or these with export potential like Quin AI, Flowla, and CarbonCentrum.

Logo Ventures, which invested in startups in Türkiye, Central and Eastern Europe and Baltic nations final 12 months, contributes to the journey of globalization for ventures by opening its business community to them, aiming to assist them attain a greater place rapidly.

Furthermore, it launched an progressive strategy to funding analysis in 2023, deploying data-driven analysis software program to streamline and improve funding processes.

Extensive datasets collected from varied sources are interpreted by means of a specifically developed utility for the fund, enabling Logo Ventures to guage new ventures quickly and systematically with out bias. Through this methodology, the fund goals to extend effectivity and success in funding processes.

Merve Zabcı, managing accomplice at Logo Ventures, affirmed their dedication to investing in ventures shaping the long run, offering not solely monetary assist but in addition entry to worldwide mentors and a worldwide investor community.

Looking forward to 2024, Logo Ventures plans to deal with AI purposes in varied sectors, cybersecurity and local weather applied sciences.

“We proceed to spend money on startups that may form the long run with their merchandise and applied sciences. After the funding, we not solely present monetary assist to ventures but in addition open up our worldwide mentor and international investor community,” stated Zabcı.

“Our intention is to foster profitable ventures within the international competitors from this area. In this context, we plan to prioritize specializing in varied sector purposes of synthetic intelligence, cybersecurity and local weather applied sciences within the 12 months 2024.”

Akbank launches $100 million funding fund

Major Turkish non-public lender Akbank has initiated its international investments within the entrepreneurship ecosystem with a $100 million fund by means of Akbank Ventures whereas implementing open innovation alongside company entrepreneurship and entrepreneurs by means of Akbank Lab.

Speaking on the Annual Türkiye Entrepreneurship Ecosystem Event, Burcu Civelek Yüce, deputy common supervisor in command of Retail Banking and Digital Solutions at Akbank, stated Akbank Lab is open to all entrepreneurs.

“We established Akbank Lab in 2016 with the intention of conducting open innovation with monetary expertise startups from all over the world, integrating innovation into our personal construction and selling an inner tradition of entrepreneurship. We carried out proof-of-concept research with almost 40 monetary expertise startups, bringing 16 of them to life. Unknowingly, hundreds of thousands of customers are actually utilizing these purposes,” stated Yüce.

“We linked these startups with hundreds of thousands of shoppers and customers who log in hundreds of thousands of occasions, bringing progressive options to our clients and the establishment. This is a useful alternative for these entrepreneurs. Additionally, we launched the Akbank+ inner entrepreneurship program. We invested $1 million in complete, $500,000 every, in two entrepreneurs: Westlog and Volt. Now, we now have began the second spherical.”

International funding alternative

Regarding Akbank’s function as a worldwide investor, Yüce defined that as of April 2023, they established a company enterprise capital firm within the Netherlands, the place they deal with investments within the international startup ecosystem.

“We have identified three general investment strategies. We can invest through existing private equity and venture capital (VC) companies. We can directly invest in startups worldwide. In 2023, we collaborated with seven different partners,” she famous.

“We can establish the areas we invested in throughout 2023 and can deal with in 2024 as follows: We strongly consider in options for sustainability. We are able to collaborate with those that have options and startups in digital forex, tokens, generative AI, regenerative finance, and Web3.”

Fujifilm’s innovation ensures aggressive edge for 90-year-old firm

Over the previous 30 years, as pictures and imaging applied sciences have transitioned into the digital realm, some manufacturers have disappeared whereas others have remained standing because of the ability of innovation and their capability to adapt rapidly.

During the period when digital pictures and videography flourished, many manufacturers did not survive. Brands similar to Kodak, Agfa, Konica Minolta and Rollei vanished, whereas Fujifilm managed to remain afloat with its progressive investments.

Celebrating its ninetieth anniversary this 12 months, Fujifilm positions itself as one of many foremost expertise corporations globally, conducting its operations pushed by the mission to boost the standard of life for folks worldwide.

Fujifilm’s dedication is clear by means of its Open Innovation Hub, a platform aimed toward fixing societal points and fostering new values underneath the precedence areas of setting, well being, each day life and work model, as outlined in its Sustainable Value Plan 2030 (SVP2030).

Building future

Present in Türkiye since 2012 as Fujifilm Foreign Trade Inc., the corporate actively operates in varied sectors together with medical programs, graphic programs, industrial merchandise, digital cameras and picture printing merchandise.

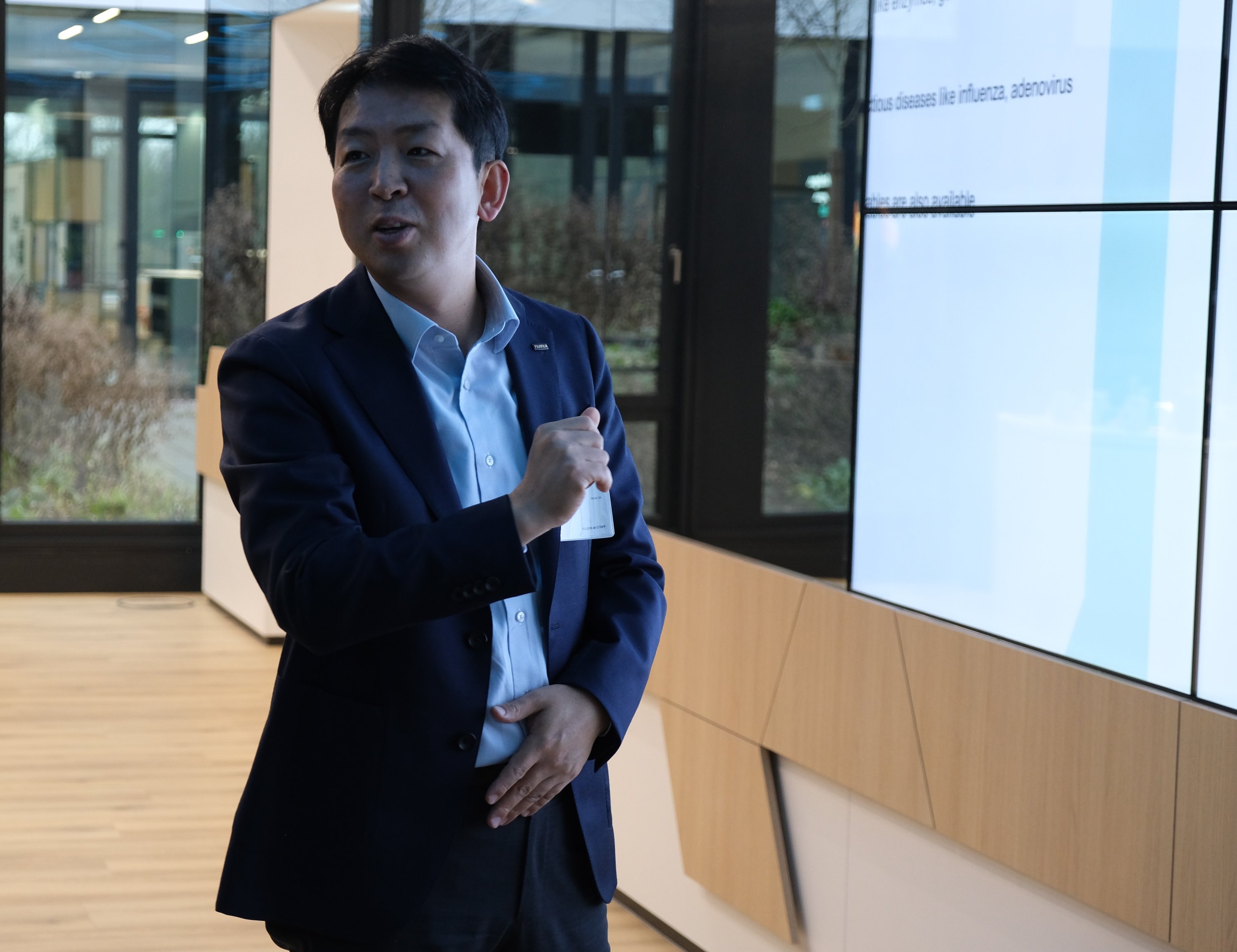

Keitaro So, head of Fujifilm Türkiye and Fujifilm Healthcare Türkiye, attributes the corporate’s success in swiftly adapting to digital transformation to its progressive capabilities and strategic acquisitions made on the proper time.

“Fujifilm makes use of ‘open innovation’ strategies to boost its innovation actions. It collaborates with companions to develop new options and seeks alternatives to accumulate applied sciences and companies by means of M&A or small investments in startups. To assist these open innovation approaches, amenities are supplied for guests to encourage, focus on and brainstorm,” stated Keitaro.

“With the company slogan ‘Value from Innovation,’ Fujifilm brings collectively varied progressive applied sciences, views and competencies with a versatile mindset, creating new worth for purchasers and constructing a greater future for everybody.”

Innovation competitors

In a bid to encourage innovation amongst Turkish college students, Fujifilm organized an open innovation competitors in 2023, aiming for the creation of high-quality tasks that could possibly be applied.

The Fujifilm Innovation Competition, with its algorithm named “Özgelecek,” attracted participation from undergraduate, graduate and postgraduate college students, making it one in all Türkiye’s most complete and distinctive competitions.

During the competitors, 95 groups developed tasks underneath the metaverse class, 21 groups underneath Fujifilm Technologies, and 183 groups underneath local weather change.

Segregating waste oil

Its second time period has attracted 1,422 purposes deciding on one of many three classes and making use of by means of kargakarga.com. The groups from 49 completely different cities and 63 universities began not solely a contest but in addition a pure studying course of.

The successful staff within the local weather change class was FAMK, specializing in segregating family waste oil utilizing a CBS system, changing them into biofuel to contribute to the financial system and interact the general public within the struggle towards local weather change.

The FAMK initiative earned the chance to go to the Fujifilm Innovation Hub.

Ahmet Fatih Akansu, a member of the staff alongside Meryem Payveren and Alieren Sarı, visited the middle that opened in July 2022 in Ratingen, Germany.

The middle, constructed upon Fujifilm’s experience in photosensitive supplies, serves as an area the place cutting-edge applied sciences, repeatedly developed by means of collaborative tasks, are merged with wants and concepts to create new values.

Source: www.dailysabah.com