Argentine President Alberto Fernandez final yr signed up for the Belt and Road Initiative (BRI) to obtain greater than $23 billion in Chinese investments.

Argentina is looking for to realign business relations with China, as bilateral commerce with the Asian large has opened up a $9.5 billion commerce deficit, constricting the Latin American nation’s already strained financial system.

From $2.3 billion in 2001 to $26 billion final yr, Beijing has grow to be the second-largest commerce associate of Buenos Aires and has elevated its footprint within the Argentine financial system.

The complete worth of Sino-Argentine bilateral commerce stood at $450 billion as of 2021.

In January, Argentina’s Foreign Minister Santiago Cafiero sought to deal with the commerce imbalance and discover methods to get equal footing in coping with the world’s second-largest financial system.

During a gathering along with his Chinese counterpart Qin Gang, Cafiero reaffirmed the 2 nations’ strategic relationship and mentioned it was important “for our country to build together a more balanced and diversified bilateral trade, and to speed up the market opening processes for Argentine products”.

Over the previous 20 years, the 2 nations have solidified their partnership, enhancing commerce and funding flows by means of three way partnership tasks in rail transport, vitality, mining, infrastructure and public works. Argentina has additionally obtained quite a few Chinese loans and investments in mining, oil and gasoline, hydropower, nuclear vitality, photo voltaic vitality, biodiesel, transportation, telecommunications and digital sectors.

“Throughout the 21st century, China has become one of Argentina’s main trading partners. It is one of the three most important destinations for Argentine exports along with Brazil and the European Union,” says Luciano Moretti, a researcher on the Santa Fe-based National University of Litoral.

High export commodity costs marked this business relationship, with Argentina exporting agricultural produce – largely soybeans and their derivatives – and importing a spread of manufactured items, equipment and applied sciences from China.

Moretti says this created a commerce stability that was initially beneficial for Argentina however “eventually became a deficit”.

During his dialog with Gang, Cafiero additionally described it as “important” to advance with China financing infrastructure tasks, one thing Chinese banks haven’t carried out since 2019.

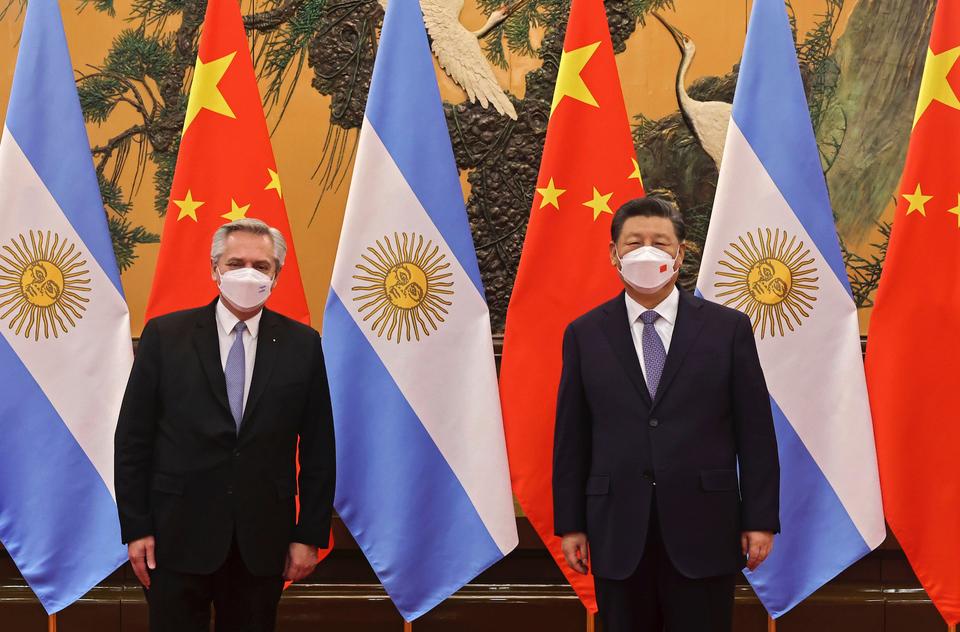

(Liu Weibing / Xinhua by way of AP)

While there was success with Chinese funding in tasks such because the Belgrano Cargas Railway and the Cauchari Solar tasks in Argentina’s northern province of Jujuy, there have additionally been setbacks.

The development of the Nestor Kirchner and Jorge Cepernic hydroelectric crops has confronted pushback from environmentalists and the indigenous Mapuche folks, who argue that improvement in Argentina’s southern province of Santa Cruz comes on the danger of impacting glaciers and biodiversity.

One joint nuclear vitality challenge additionally seems to be dealing with difficulties. The potential development of the Atucha III nuclear plant in Buenos Aires province – which makes use of a China-designed Hualong One reactor – appears to have hit a stumbling block over funds. Some studies counsel that the challenge’s future is “ambiguous”, with China dedicated to investing 85 % of the associated fee, round $8 billion, whereas Argentina pushes for full funding.

However, there could also be developments on the horizon.

Last yr, as each nations celebrated 50 years of diplomatic relations, Argentine President Alberto Fernandez met President Xi Jinping in China and signed up for Beijing’s pet challenge, the Belt and Road Initiative (BRI), to obtain greater than $23 billion in Chinese investments.

According to Moretti, China doesn’t require nations to formally be a part of the BRI to obtain financing or investments, describing the BRI in Latin America as a “set of infrastructure projects that China had previously announced and that now seem to fall under the umbrella of this initiative”.

Amid Argentina’s deep financial disaster, Leandro Marcelo Bona, a researcher on the National Scientific and Technical Research Council and the National University of La Plata, says the BRI gives financing alternatives for infrastructure tasks that world south nations can not simply get hold of. He notes advantages between China and its companions which can be aimed toward bettering export capability, productiveness and commerce, avoiding conditional financing supplied by different credit score establishments.

Moretti describes these Chinese loans and investments as adhering to a coverage of non-intervention within the inner affairs of nations whereas its loans don’t deliver any “collateral of a political nature”.

“In this aspect, it differs, for now, from traditional international lenders, such as the IMF, which usually condition financial aid to regressive political and economic reforms in social and productive matters. This does not mean that China does not have a geopolitical and economic interest in its relationship with Argentina, nor that cooperation is free,” argues Moretti.

Critics, nevertheless, argue that low-cost loans supplied by China come on the danger of placing nations in Beijing’s “debt trap”.

To date, Argentina has obtained 36 business financial institution loans and 13 coverage financial institution loans from China.

However, Bona means that Chinese banks are rising extra cautious, primarily as a consequence of rising money owed amongst companions in Africa, the place Beijing has struggled to recuperate its cash and is now enterprise debt-restricting negotiations.

“The other side of this financing is that it favours Chinese interests in obtaining foodstuffs and energy from countries of the South, reproducing an uneven development pattern, where added value is concentrated in China, and the regional countries continue to depend on commodity prices,” says Bona.

Amid the push to decarbonise and the world’s vitality transition, lithium is one strategic financial space of cooperation. The white steel is a vital useful resource for the burgeoning electrical car and digital items market, whereas South America’s Golden Triangle — made up of Argentina, Bolivia and Chile — is the place 50 % of the world’s lithium deposits are estimated to be situated.

As China leads the way in which in refining and producing the useful resource, main corporations like Jiangxi Ganfeng Lithium Co., Hanaq Group, Tsingshan Holding Group, and Zangge Mining Group Ltd are overseeing tasks or have investments in Argentina.

In current years, China has invested extra within the lithium sector than different nations just like the US, Canada and Australia. More than 42 % of Argentina’s lithium exports head to China.

In January, each nations demonstrated their monetary cooperation, formalising the enlargement of a $5 billion foreign money swap to bolster Argentina’s hard-hit overseas foreign money reserves and to assist with commerce prices and debt repayments, notably with an IMF deal in place. The foreign money swap was first agreed upon in 2009 throughout former President Cristina Fernandez de Kirchner’s tenure and continued underneath successive Argentine administrations.

Internationally, China has additionally backed Argentina’s push to grow to be a member of BRICS, the 5 rising bloc economies comprising Brazil, Russia, India, China, and South Africa. Fernandez famous how the bloc represents 42 % of the worldwide inhabitants and 24 % of the world’s GDP, mixed with new monetary alternatives with the enlargement of the New Development Bank (NDB) or the BRICS Development Bank.

Local newspaper Cronista suggests Argentina’s accession to BRICS would strengthen its financial system, whereas Fernandez underscored “the prospect of coordinating policies that enhance the agenda of the countries of the Global South”.

In the longer term, analysts anticipate Argentina and China to deepen cooperation in business, monetary and political phrases however notice potential challenges.

Amid the US and China’s geopolitical and business dispute, they are saying Argentina’s incorporation into the BRI didn’t go unnoticed in Washington.

“Let us remember that the US considers Latin America as its backyard and sees the entry of external powers into the continent as a possible threat to its security. Argentina must have enough manoeuvring capacity to avoid being trapped in this dispute between two great powers,” argues Moretti.

Bona underscores how the US perceives South America as “a ‘natural’ part of its sphere of influence (just as the China Sea is for the Asian giant)” and means that “it could lead to a more aggressive strategy by the US (which has greater potential through its financial channel) to avoid the growing weight of China in the region.”

Source: TRT World

Source: www.trtworld.com